Navigate International Waters: Secret Steps in the Formation of Offshore Companies

Tailored Offshore Firm Monitoring Solutions

Customized offshore company monitoring solutions use a critical method to navigating the complicated globe of global company. In this conversation, we will certainly explore how tailored options can aid services achieve their objectives, while likewise analyzing the advantages of leveraging offshore business management solutions.

Benefits of Offshore Firm Monitoring

Offshore territories commonly use desirable tax regimes, enabling business to lessen their tax obligation liabilities legally. By developing an overseas entity, businesses can take advantage of reduced or zero company tax rates, as well as exceptions on funding gains, rewards, and inheritance taxes.

Another benefit of overseas business administration is improved privacy and discretion. This level of anonymity can be appealing to individuals who wish to keep their company tasks private.

Offshore business management additionally offers raised property protection. By holding possessions offshore, people can secure them from prospective lawful cases or creditors. Offshore territories commonly have solid possession defense laws, making it tough for external events to seize or access these assets. This can supply peace of mind and guard personal wealth.

Finally, overseas business monitoring can promote international business operations. Developing an overseas entity can offer organizations with a local visibility in a foreign market, enabling them to broaden their international reach. This can lead to new service chances, accessibility to international financing, and the ability to cater to a wider consumer base.

Tailored Solutions for Company Growth

Tailored remedies for organization expansion include tailored approaches and techniques that accommodate the unique demands and goals of firms seeking to grow their operations. As services progress and adjust to the ever-changing market characteristics, it ends up being vital for them to develop customized services that resolve their specific requirements. These services take right into account aspects such as market conditions, sector trends, competitive landscape, and internal capabilities.

Among the vital elements of customized solutions for organization expansion is market research. Business need to extensively assess the target market to identify growth possibilities, understand consumer preferences, and analyze the competitive landscape. This research helps in creating approaches that align with the marketplace dynamics and guarantee a competitive benefit.

Another important part of customized remedies is strategic preparation. Business require to define clear purposes and goals for their expansion strategies. This consists of determining prospective markets, making access approaches, and outlining the essential resources and investments needed for successful development.

Furthermore, customized remedies for business development might involve partnerships and partnerships with other companies. This can aid firms utilize the expertise and sources of strategic partners to accelerate their development strategies.

Maximizing Tax Optimization Opportunities

Maximizing tax optimization opportunities requires an extensive understanding of tax obligation laws and guidelines, as well as critical preparation to lessen tax liabilities while remaining compliant with lawful demands. Offshore firm monitoring solutions use organizations the chance to maximize their tax planning approaches by capitalizing on territories with beneficial tax obligation regimes. By establishing an offshore business, companies can benefit from numerous tax obligation motivations, such as lower business tax obligation prices, tax obligation exemptions on specific types of earnings, and the ability to delay or decrease tax obligations on earnings earned abroad.

One key element of optimizing tax obligation optimization opportunities is to carefully examine the tax laws description and laws of different jurisdictions to recognize one of the most beneficial alternatives for business. This calls for an extensive understanding of the tax obligation landscape and the capability to navigate intricate global tax obligation structures. Additionally, critical planning is important to make sure that the service framework is completely compliant with lawful demands and avoids any type of possible threats or penalties related to tax obligation evasion or hostile tax obligation evasion schemes.

Another vital consideration in tax optimization is using tax treaties and agreements between countries. These contracts can aid businesses avoid double taxation and supply mechanisms for settling tax conflicts. By leveraging these treaties, services can further optimize their tax strategies and reduce tax obligation responsibilities.

Ensuring Property Defense and Discretion

To guarantee the utmost security of assets and keep stringent confidentiality, businesses must apply durable techniques and methods. Guarding possessions from possible risks and hazards is necessary in today's competitive service landscape. Offshore business administration services supply a variety of actions to make sure asset protection and discretion.

One trick technique is the separation of individual and company properties. By establishing an overseas company, company proprietors can separate their individual possessions from those of the company. This splitting up offers a layer of security, ensuring that personal assets are not at threat in the occasion of legal problems or financial problems encountered by the business.

One more vital element of property protection is the execution of strong legal frameworks and devices. Offshore jurisdictions often supply positive lawful structures that give boosted asset protection. These structures may consist of trusts, foundations, or limited obligation business, amongst others. By making use of these frameworks, businesses can protect their possessions from lawful conflicts or potential financial institutions.

Privacy is similarly essential in preserving the privacy and protection of organization possessions. Offshore jurisdictions normally have strict confidentiality laws that shield the identities of useful owners and shareholders. These regulations make sure that delicate details continues to be confidential and hard to reach to unauthorized people or entities.

In addition to legal structures and privacy legislations, companies can additionally improve possession defense through making use of nominee solutions. Nominee supervisors and investors can be appointed to act upon part of the company, including an additional layer of privacy and privacy.

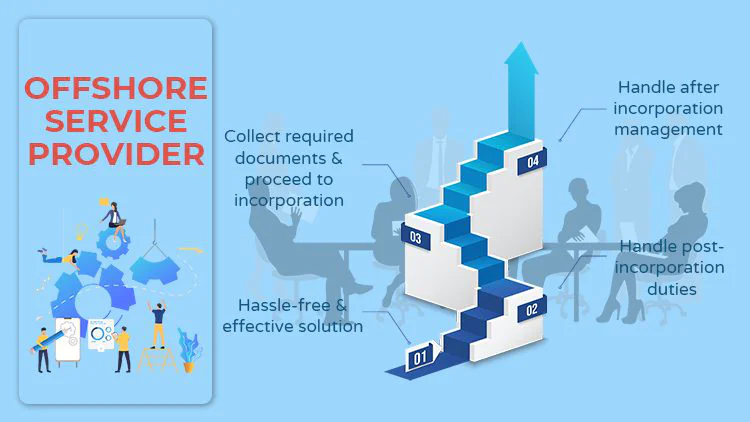

Leveraging Offshore Firm Administration Services

Offshore firm administration services use companies a critical benefit in maximizing procedures and attaining worldwide expansion. These services give companies with the competence and sources required to browse the complexities of worldwide markets and regulations. By leveraging overseas company monitoring services, companies can take advantage of a series of benefits.

One of the vital benefits is the capability to access new markets and touch right into a global client base. Offshore firm management services can assist businesses establish an existence in international markets, allowing them to increase their reach and enhance their client base.

In have a peek at this site addition, overseas company company website management services can supply businesses with cost-saving possibilities. By developing procedures in overseas territories with favorable tax regimens, businesses can decrease their tax obligations and raise their productivity. These services can help services in accomplishing operational effectiveness with streamlined procedures and accessibility to specialized sources.

An additional benefit of leveraging overseas firm administration services is the enhanced asset defense and discretion they supply - formation of offshore companies. Offshore territories often have durable lawful frameworks that safeguard assets from lawful disputes, financial institutions, and various other dangers. This can supply businesses with assurance and guarantee the long-term security of their properties

Verdict

To conclude, overseas company monitoring remedies use various advantages such as organization development, tax obligation optimization, property security, and discretion. By leveraging these solutions, services can tailor their procedures to satisfy their particular demands and optimize their success in the global market. With a concentrate on effectiveness and experience, offshore firm administration gives a calculated benefit for companies looking for to increase their operations internationally.

In this discussion, we will discover just how tailored services can assist services achieve their objectives, while also checking out the advantages of leveraging overseas company monitoring services. Offshore business monitoring solutions use businesses the opportunity to enhance their tax obligation planning approaches by taking benefit of jurisdictions with positive tax programs. By developing an offshore firm, companies can profit from different tax obligation incentives, such as lower company tax rates, tax exceptions on particular types of income, and the capability to postpone or reduce taxes on revenues made abroad.